Above: Image via whitehouse.gov

By Steve Horn

Third in a series on FedEx, UPS, and their positions on taxes and jobs

As President Trump prepared to pitch the job-creating effects of his proposed tax cuts Wednesday night to hundreds of truckers at a speech in Harrisburg, PA, a representative for a truckers’ union group told TYT the Teamsters are gearing up for a contract battle with UPS—one of America’s biggest employers—to protect trucking jobs from being cut in favor of non-staff drivers.

As TYT has previously reported, both UPS and FedEx have endorsed Trump’s claim that his tax cuts will create jobs, and lobbied Congress to pass them. Neither company has said it specifically needs tax cuts in order to hire new employees, and both already have billions of dollars of cash on hand.

Instead, both companies plan to invest hundreds of millions of dollars in automating functions now performed by their workers. The plans anticipate years of increasing automation, ranging from scanning and sorting of packages to driverless trucks and drones capable of delivering packages in both remote and highly populated areas.

Trump’s event Wednesday night was promoted by the American Truckers Associations, a trade group representing trucking companies, which has advocated for tax cuts. ATA’s chairman in 2015 was Pat Thomas, who oversaw UPS lobbying at the time as senior VP, state government affairs. ATA’s current treasurer is FedEx Freight President and CEO Mike Ducker.

The coming contract battle at UPS involves a new program that was reflected in company job listings, reviewed by TYT, that first began appearing on UPS’s LinkedIn page in August. The program involves holiday-season hiring of non-staff drivers, referred to in the job listings as “Seasonal Personal Vehicle Package Drivers.”

According to the job listings, the company will use not just non-staff drivers, but the drivers’ own vehicles. Both tactics may have implications for the number of jobs held at UPS by full-time staff drivers, mechanics, and other personnel.

TYT was able to identify UPS job listings for the program in Minneapolis, Minn.; Traverse City, Mich.; Santa Rosa, Calif.; Milwaukee, Wis.; and Brownsville, Texas.

In a September 1 letter posted online by the Teamsters, which represents UPS drivers and other workers, the union’s Package Division Director Sean O’Brien wrote to the company objecting to the new program.

“There is nothing in the contract that permits the use of non-company vehicles to deliver or pick up ground packages,” O’Brien says. “Your proposal neither provides job opportunities for current employees nor full contractual benefits and protections for the seasonal drivers.”

O’Brien also warns that the Teamsters intend to fight the UPS plan, saying, “We would consider any attempt by the company to initiate such a program to be a violation of the current contract and will invoke all of our rights to prohibit such implementation.”

UPS President of Corporate Labor Relations Al Gudim responded the same day in a letter obtained by TYT, calling O’Brien’s claims, “factually and contractually without merit.”

The Teamsters declined to comment for this story. David Levin, spokesperson for a union dissident group called Teamsters for a Democratic Union, told TYT that the union can challenge UPS’ use of personal-vehicle drivers through its grievance procedures. But Levin said the process moves slowly, so the issue is more likely to be negotiated head-on during the next round of contract talks, set to begin in January.

UPS has declined to respond to questions from TYT, aside from referring to a previous statement supporting the Trump tax cuts.

The company, however, is also pursuing other means of reducing its need for staff truck drivers, in what has been called the “Uberization” of UPS by Joe Allen, author of The Package King: A Rank and File History of United Parcel Service.

Coyote Logistics

In 2015, UPS bought Coyote Logistics for $1.8 billion. Coyote serves as a broker for the shipping and logistics industry, serving the trucking industry in a manner similar to the way Uber and Lyft serve individual riders.

The acquisition enhanced UPS’s ability to subcontract deliveries out to non-staff drivers.

“The combination of UPS assets and Coyote’s dense network of committed carriers translates to innovative capacity solutions in both atypical and typical market conditions,” Coyote’s website says.

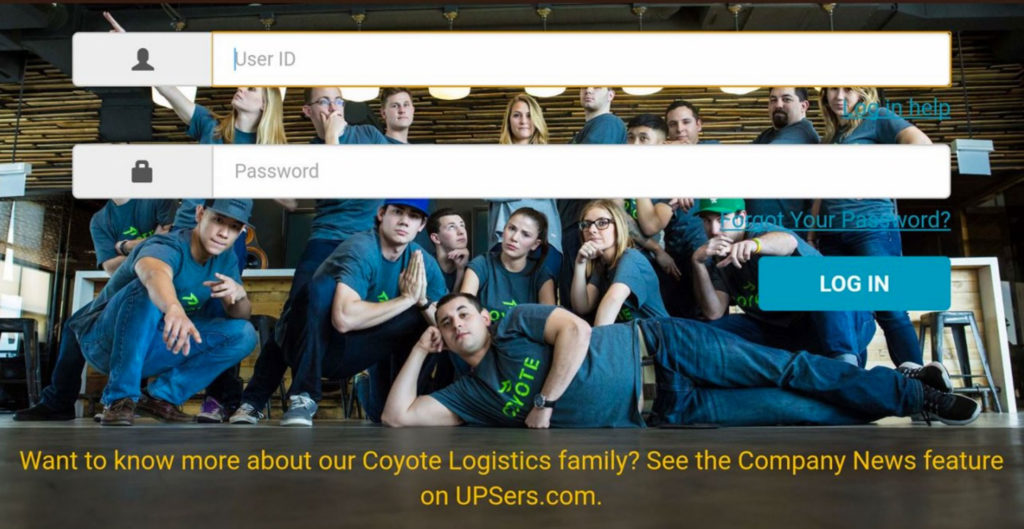

Photo Credit: BrownCafe

On BrownCafe, an unofficial message board for UPS employees, one post in July said, “If anyone has bothered to try to login to Upsers.com recently you will see a picture of a bunch of 20 somethings posing with Coyote Logistics t-shirts. As a feeder driver I have to admit I take that as a bit of a slap in the face in light of all the subcontracting going on and Coyote being the new division that is leading the way. Subcontracting is allowed on the UPS Freight side and my guess is the company will push hard during this negotiation period to relax subcontracting language just like they have on Freight.”

The 2015 UPS annual report refers to Coyote’s potential, saying, “The acquisition added large scale truckload freight brokerage and other transportation management services to our Supply Chain & Freight reporting segment. In addition, we expect to benefit from synergies in purchased transportation … as well as technology systems and industry best practices.”

The business consulting company Deloitte said in a 2016 report that acquiring Coyote, “will also allow UPS to tap a large network of contract carriers during the peak shipping season, helping it manage peaks in demand using shared assets.”

UPS has also invested in other Uber-like shipping and logistics companies.

In 2015, UPS was one of the founding investors for Roadie, contributing to the $10 million seed funding, and then in 2016 making another investment into the Atlanta startup, which pays non-staff workers driving their own vehicles to deliver packages.

Last year, the UPS Strategic Enterprise Fund invested in Deliv, a same-day delivery service for retail stores and other businesses that uses non-staff drivers and their vehicles.

In a February 2016 press release about the investment, UPS Executive VP and Chief Commercial Officer Alan Gershenhorn said, “Our Strategic Enterprise Fund continues to invest in companies that have innovative business models, and we look forward to gaining further insights into the market dynamics of same-day delivery.”

According to Levin, the UPS union worker, “Politicians who want to push through tax breaks for the rich talk up job creation. But UPS uses cash reserves to eliminate good jobs, not create them, by automating their hubs and subcontracting driving work to nonunion subsidiaries like Coyote Logistics.”

Referring to the contract talks, Levin said, “UPS workers are demanding 15,000 full-time jobs for part-timers, limits on excessive overtime for drivers, and stiffer restrictions on subcontracting in the next contract. A union campaign can create more good jobs at UPS. A corporate tax cut? Give me a break.”

To stay up-to-date on all TYT Investigates exclusives, follow us on Twitter and Facebook.